Wheat Market - From Then to Now

If you have had your finger anywhere close to the agricultural market in the past few years you know it is somewhat depressed. Especially, since we hit highs for corn around $7/bu back in 2013. This was such a rapid incline in grain prices that it somewhat threw the markets out of balance. Anyone that has remotely studied markets is familiar with the pendulum effect. If a market swings drastically in one direction, it is bound to swing back just as hard - if not harder - in the opposite direction.

This market effect could be potentially unfolding before our eyes this summer. Heat waves around the world are driving the price of wheat higher. Europe and Asia are seeing abnormal heat, which is burning up the wheat crop on these geographical regions. While the United States has seen heat as well - it hasn't necessarily been in wheat country. We live in a tremendously global market environment. The prices we see daily, are affected by what happens across the pond and all over the world.

European & Asian Wheat Farmers

Therefore, the distress that European and Asian farmers are currently experiencing is positively impacting the US wheat farmer. Simple supply and demand is causing this increase in the wheat market. Because there is less supply going into the market place from our European and Asian competitors, their 2018 wheat crop is expected to be less than the forecast. Whenever there is a shortage in a market, the commodity begins to increase in price. The less you have of something the more valuable it becomes.

Russia, Ukraine, France, and Great Britain are all European countries which have wheat farmers that are being negatively impacted by the 2018 heat waves. On August 2nd, Chicago wheat futures hit three-year highs to around $5.50/bu (The Wall Street Journal).

A Look Back into History

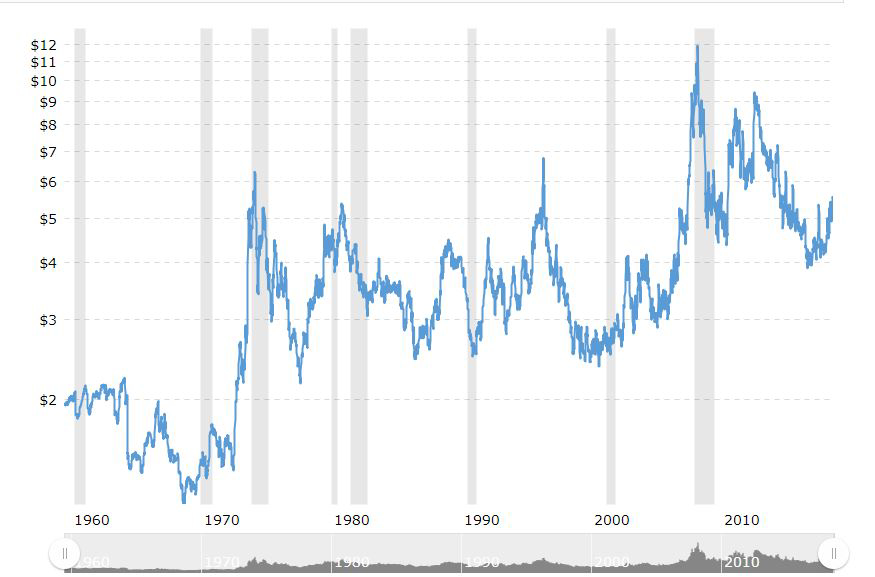

Looking at an aggregate chart of wheat prices since 1960, we can see fairly large market clips occurring about every seven to ten years. On average, these pullbacks are about 50% down from the high. The most recent high was back in December of 2007 at just under $12/bu. We seem to have found a level of support at roughly $4/bu. Currently, we are sitting at a $5/bu.

Wheat Prices Since 1960, Source: www.macrotrends.net

Looking at historical trends it appears as though wheat prices are on the up-and-up. It seems that the market has found a much more agreeable level of support. I say 'agreeable' since one can clearly see the higher lows met with higher highs in 2016-2018. We did not see this back in 2010-2012 failed rally. The market wasn't ready to correct and thus we were sent into a further recession.

Now, it seems the market is posed to regain the losses from 2012. Where we have seen about a 57% clip in the price of wheat - to the low in August of 2016.

Sometimes markets require a little extra push or catalyst to take off. A shortage in supply can absolutely be that catalyst. The US is positioned well in the current global wheat market and pose to reap the rewards of healthy crops.

Is an Increase in Wheat Futures a Certainty?

Now, we must acknowledge the tariff war and how that could potentially affect US wheat farmers. China has imposed tariffs on American grain and oil-seed imports. If we could look at wheat prices in a vacuum, one would say the US wheat farmer is posed to prosper over the next few years. The global supply and demand issues we addressed above, along with the technical analysis of the chart presented above both suggest this is the case. However, trade wars generally don't impact the farm market in a beneficial manner. It's difficult to say what is going to happen but all things aside - wheat looks posed to make a run.

As always we hope you find this post to be informative and educational. You may ask yourself how Dultmeier Salescomes into play in the wheat market. We offer a wide product selection to help enable producers plant, fertilize, and protect their crops through herbicide/fungicide applications. Check out our Agricultural Division page here. Stop back soon!